How to Choose: Sole Proprietorship vs LLC vs S Corp

What are business entities?

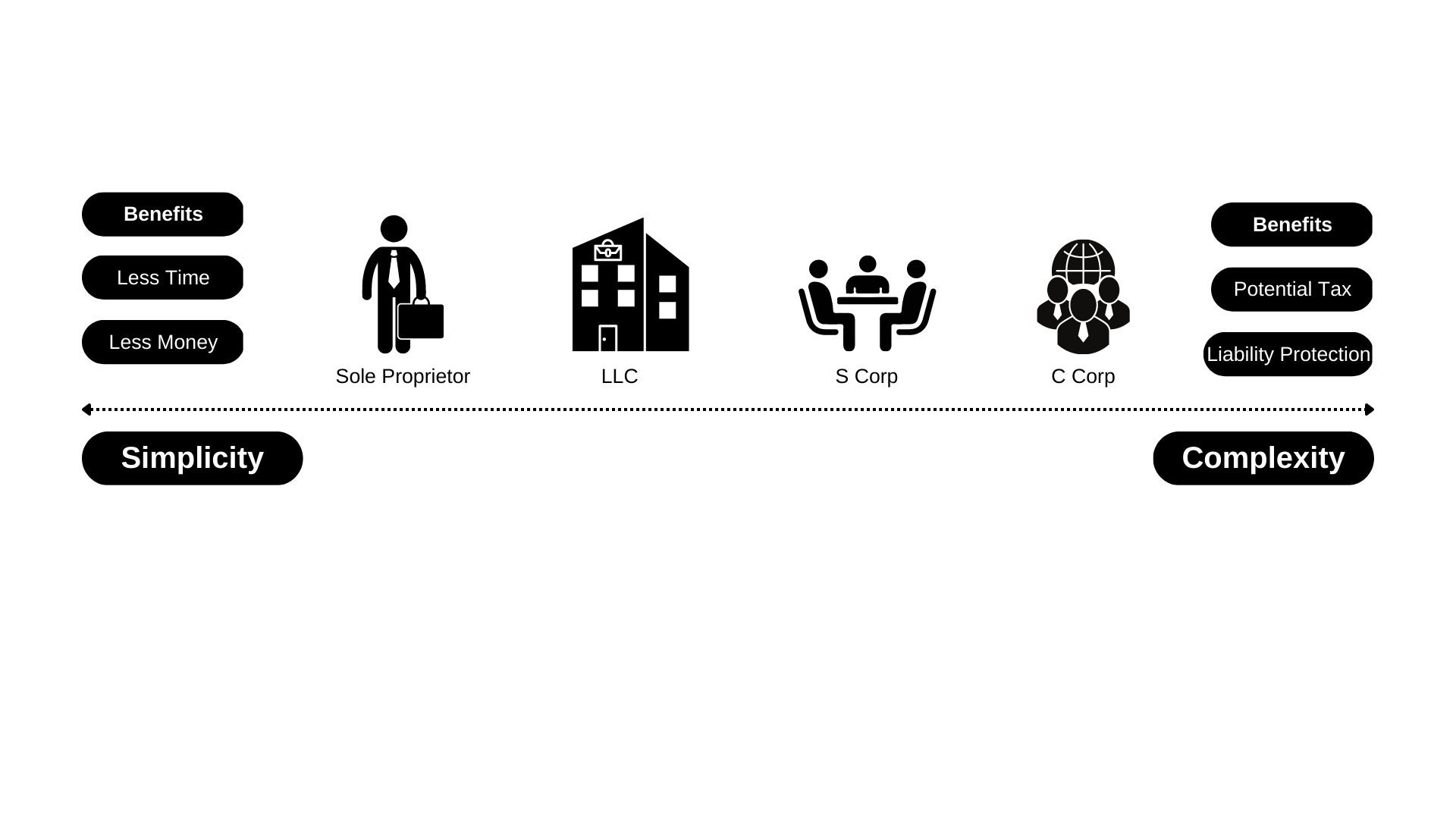

I’m sure you’ve heard of them before: LLC’s, Corporations, etc. They are a way of classifying your business with the state in the legal address you picked for your business. This allows you to choose along the Simplicity – Complexity scale where you want your business to lay.

Business Entity Options:

· Sole Proprietor

· LLC

· S Corp

· C Corp

For simplicities sake, we’ll just focus on these four, but note if you are forming with a partner there are two other options: General Partnership (treated like Sole Proprietor) & Limited Partnership (treated like an LLC).

Let’s quickly talk about the factors at play here:

Liability Protection: The farther along the scale you go, the more separation there is between you personally & your business entity. This means that you are not personally on the hook for business debts. Also, if a lawsuit were to happen, your personal assets would not be in play. This general increase in business & personal separation also helps you complete tasks like opening a business bank account and/or credit card.

Tax Benefits: For most small businesses the main potential here for tax savings will be the option to pay yourself with a combination of payroll and owner distributions. The amount paid out via distributions can save you around 7% on FICA taxes. You don’t need to know the specifics of this now but know that this is an option down the road. If this is an appealing prospect to you then setting yourself up now to be able to initiate this strategy in the future is a better option than trying to change your entity completely down the road.

Requirements: These include initial fees to set up with the state as well as having to go in annually to renew your entity with the state and pay a renewal fee as well. These fees are generally low though so I wouldn’t worry too much about it. Also, generally speaking, the farther down the scale we go, the more solid your bookkeeping needs to be. The only requirements to really start worrying about are things like creating bylaws and holding board meetings when looking at the S Corp & C Corp entity options.

Now, let’s list out some attributes for the choices based on the factors listed above:

Sole Proprietorship:

Liability Protection: No

Taxed: Personal Pass Through (No Payroll option benefits)

Requirements: Easy, no state filing needed (other than a “dba” or “trade name” potentially depending on state)

LLC:

Liability Protection: Yes

Taxed: Can Choose (more on this later)

Requirements: Medium, must file with state & annual renew

S Corp:

Liability Protection: Yes

Taxed: As Corporation (Payroll benefit option)

Requirements: High, have to create bylaws, board meetings, etc.

C Corp:

Liability Protection: Yes

Taxed: As Corporation (Payroll benefit option)

Requirements: High, expensive and many requirements

Let’s simplify and narrow things down here for you:

I believe right off the bat you can most likely eliminate C Corp from your decision list. I also believe that most small businesses can also eliminate the S Corp entity option unless you plan on having shareholders involved. Why? They are overly complicated for most small businesses at their beginning stages, and you can still reap the tax benefits because of the amazing option of being able to choose to be taxed as a corporation at the LLC entity level.

So, now we have Sole Proprietor vs LLC. Ultimately, it’s up to you and Sole Proprietor is very easy to form, but I am going to try and make a case for you to form an LLC.

First, LLC fees are relatively low. You’ll see a one-time sign-up fee and then an annual renewal fee which for my state right now is $10. In my opinion, the benefits outweigh the costs. The biggest benefit is being able to choose and change how your business entity is taxed. When you form an LLC, the tax treatment by default is a personal pass-through entity, the same as a Sole Proprietor. This is great to keep it this way at the beginning because it really simplifies things. You can transfer money in and out from your personal funds without having to worry about things like payroll.

Then, once a certain revenue threshold is hit and you want to pay yourself payroll to save money on taxes, all you have to do is keep the LLC entity and change the “Taxed As” option to S Corp. Then, you keep all the simplicities of the LLC entity while getting the tax benefits of the S Corp entity.

Also, having an LLC provides liability protection from your personal assets as well as business debt, a sole proprietorship does not. Finally, again, it will help you when going to open a business bank account to have an LLC formed.

In my opinion, even if you are starting a very simple business, say working by yourself doing some freelance graphic design work on the side, if you see any chance at all of this business growing, then creating an LLC would be a great way to set you up from the jump. Here’s the mistake I made when I started out: I formed a Sole Proprietorship for simplicity and financial savings. Then, I created an EIN to open my Business Bank Account. After, I learned that forming an LLC would have been best for the reasons mentioned before. When I changed to an LLC, I also needed to get a new EIN, as it doesn’t carry over. So, I had to call my bank and go through a stringent process to get this EIN changed in my bank account. Also, I needed to send out all new W9’s to my clients for 1099’s because of this EIN change. This all cost me more time, energy & money than if I were to have just chosen an LLC from the beginning.

In Summary:

You can decide on a Sole Proprietor Entity which may involve no registration needed with your state to start. However, you won’t have liability protection and can’t change your “taxed as” status at any point unless you first change your entity up to an LLC, which will also have a requirement to obtain a new EIN.

Or, you can start an LLC now which will involve you registering with your state and paying a fee. But, from the beginning you will have liability protection, can keep the pass-through default taxed option at the beginning for simplicities-sake, but also down the line have the option to easily change this to taxed as an s corp for tax savings. Or, if you see your small business involving shareholders, then forming an S Corp from the beginning may be the way to go, just be sure that you can fulfill all of the added requirements that come with forming an S Corp entity.