What Are Debits and Credits?

If I were to give a simple definition of debits and credits it would be this:

“Debits are a way of putting terminology to numbers entered into the left column of Journal Entries and Credits are a way of putting terminology to numbers entered into the right column of Journal Entries”.

I'm sure this means nothing to you. My hope with this article is to work backward and break down this definition so that you can gain a full understanding of what debits and credits are. What the terms “debits” and “credits” actually mean are actually really simple. However, in order for them to be understood, you need to understand what they represent, and for you to understand what they represent you need to understand a few key concepts that we will go over in this article.

Here are the topics to understand first before understanding what debits and credits are:

The Two Main Reports

The Main Categories Making Up These Reports

Accounting Must Always Balance

Bookkeeping is Journal Entries

Journal Entry Relationships With the Main Categories

What are Debits and Credits?

Now, let’s start working through these six topics. My attempt here will be to introduce these topics just enough for you to get the amount of understanding needed to fully understand what debits and credits are.

Number 1: The Two Main Reports

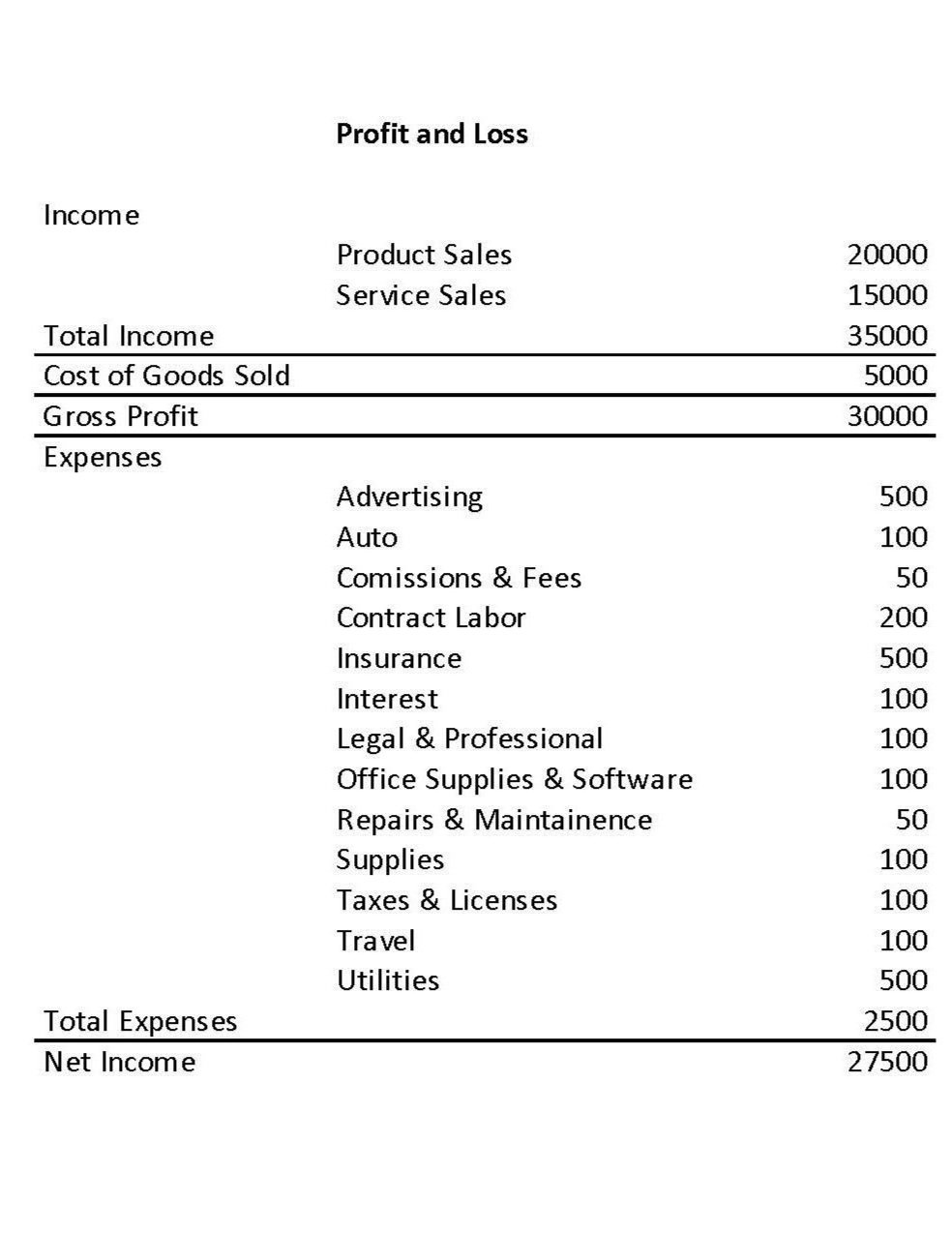

There are two reports we are going to be discussing here: The Profit and Loss Report and the Balance Sheet Report. These are the two reports that allow your small business to remain audit-proof and tax compliant. They are also very powerful reports for reviewing business health and making management-type decisions. We’ll put some simple examples below for some reference:

Simple Profit and Loss Report Example

Also referred to as: Income Statement, P&L, Statement of Earnings

Simple Balance Sheet Report Example

Number 2: The Main Categories Making Up These Reports

These two reports are formatted based on these “Main Categories”. Review the above images of some simple examples of these reports for a visualization. These are the “Main Categories” we are referring to that make up each report:

Profit & Loss:

Income

Expenses

Balance Sheet:

Assets

Liabilities

Equity

For the purposes of understanding what debits and credits are, we are not going to go into detail as to what these categories represent. For now, just understand what the categories are and how they make up these two main financial reports for your small business. We will go over a quick introduction in the next section on how these accounts interact with each other.

Number 3: Accounting Must Always Balance

I like to think of learning Accounting and Bookkeeping as learning a new language. Accounting is actually referred to on occasion as the “Language of Business”. Accounting of course has terminology to learn like debits and credits, but it also has some fundamental rules that must be followed to speak it correctly. One of these rules is that Accounting must balance.

One of the ways it must always balance is with the Journal Entries we will discuss in the next section. Another way is with the Balance Sheet Report, as the name implies, it must balance. What this balance means is that: Assets = Liabilities + Equity or the way I like to look at it: Assets - Liabilities = Equity. Both formulas are the same, just rearranged.

Again, we are not going to in this article for the goal of understanding debits and credits get too much into the “why” this Accounting must balance rule is in place. For now, just understand that the rule is there and it is there for a good reason.

Number 4: Bookkeeping is Journal Entries

With current-day bookkeeping software, I feel like this truth is sometimes forgotten. Understand this truth though, no matter how current-day bookkeeping software phrase certain business financial activities, what you are doing when creating these entries, 100% of the time are creating Journal Entries. Journal Entries are really just the actual transactions being posted when doing Bookkeeping. When you enter a new expense or send an invoice in your bookkeeping software, you are creating a Journal Entry. It’s sometimes hidden, but you can always find it by clicking on the transaction in your software and then clicking “Transaction journal”. This will show you the “actual” bookkeeping entry.

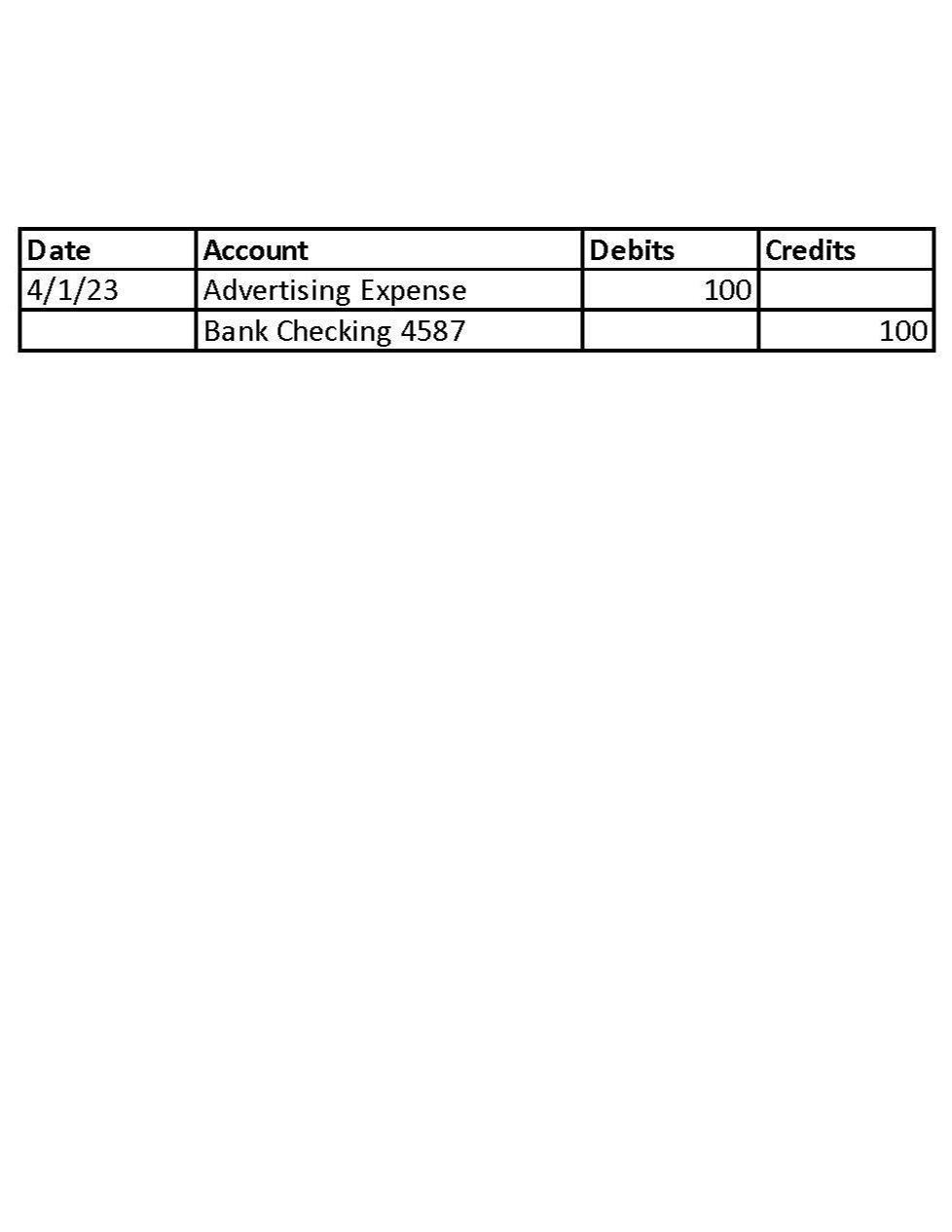

Below is an image of a Journal Entry layout for reference:

Simple Journal Entry Example

“Date” section, “Account” section and then two coulmns.

Journal Entry templates basically are a way to post business financial activities (again this is what Bookkeeping essentially is) in a way that ensures that the Accounting rule we went over that Accounting must always balance is being followed.

Most Journal Entry blank layouts have at a minimum Date and Account options as well as two columns. The “Date” option is self-explanatory. The “Account” option is the way to choose one of the “Main Categories” we discussed before: The Profit and Loss Report Categories of: Income and Expenses and the Balance Sheet Report Categories of: Assets, Liabilities & Equity. One Journal Entry can and usually does contain categories from both reports, the Profit and Loss and the Balance Sheet. The reason for this is that for a lot of financial activities to be posted, one transaction will affect both reports at the same time.

For now, understand that the two column totals in these Journal Entries must balance. What this means is the total dollar amount in the left column must equal the total dollar amount in the right column.

Number 5: Journal Entry Relationships With the Main Categories

Now, we understand that our goal with our Bookkeeping is to have up-to-date and accurate Profit and Loss & Balance Sheet Reports. These two reports are made up of five “Main Categories” that can and often do interact with each other across the two reports. As a reminder, these five main categories are:

Income

Expenses

Assets

Liabilities

Equity

We also now understand that in order to complete our Bookkeeping, we must post Journal Entries. These Journal Entries must balance, meaning that the total dollar amount in the left column must match the total in the right column. The account selection for these entries for each individual line is one of the “Main Categories” mentioned above.

Now, the next thing to understand is that when creating these Journal Entries, the “Main Category” chosen under the Account selection reacts differently (increases or decreases) based on whether the dollar amount is put in the left or right column. The reason for this is the purpose of the Journal Entry. This ensures that the “Accounting Must Balance” rule is applied. When the “Accounting Must Balance” rule is applied to the Journal Entry and the two columns match, then this ensures that the “Main Category” accounts are increasing and/or decreasing in a way that the “Accounting Must Balance” rule carries over into the two main reports we’ve been talking about: The Profit and Loss & Balance Sheet.

Let’s look at an example to help understand this:

Let’s say you get a $10,000 loan from a bank deposited into your bank account. Remember that the Balance Sheet, in order to remain balanced is: Assets = Liabilities + Equity.

Your bank account is an Asset, so the Assets section on your Balance Sheet gets increased by $10,000 to represent the $10,000 bank balance increase from the deposit. Now, you know that a Liability needs to be involved in order to record the loan payable to the bank part of this entry.

Now, let’s go back to the Journal Entry two columns. For now, know that when an Asset is entered in the left column, it increases the account balance. Now, we also know that the rule states that both columns in the Journal Entry must match, so according to the rule, the Liability line must be entered into the right column. When a Liability is entered into the right column, it also makes it’s balance increase. So, with this Journal Entry, both the Assets and Liabilities Categories on our Balance Sheet increase by $10,000 which is the correct way to record this transaction as it also ensures that our Balance Sheet remains balanced.

The main takeaway here is understanding that the Main Categories increase or decrease based on whether they are entered in the left or right columns and the reason for this is to ensure that when the entry is posted, the categories will increase and/or decrease in a way that ensures that the two main reports also remain balanced. If for some reason in the last example, the Assets Category Increased and the Liabilities Category Decreased by the same amount, then the Balance Sheet Report would become out of balance and incorrect. But, when following the Journal Entry balancing rules, this doesn’t allow this to happen.

Number 6: What Are Debits and Credits?

Now you understand that the two columns in a Journal Entry must equal and that based on which Main Categories are in each line item of the Journal Entry, their balance either increases or decreases based on if the number is placed in the left or right columns to ensure that the reports are affected in a way that keeps them in balance as well.

What are Debits and Credits?

“Debits are a way of putting terminology to numbers entered into the left column of Journal Entries and Credits are a way of putting terminology to numbers entered into the right column of Journal Entries”.

Following back here with the original definition I came up with at the beginning of this article, hopefully now it makes a bit more sense. It really is just terminology representing the left and right columns of Journal Entries.

It’s much easier to say: “Assets increase when debited” vs “Assets increase when placed in the left column of Journal Entries”. It’s really as simple as that in my opinion.

Now, the next step here would be understanding how these Main Categories are affected (whether their balance increases or decreases) based on whether they are debited or credited (whether the dollar amount in the account line gets placed in the left or right-hand column of the Journal Entry).

I don’t think understanding the actual relationships here is vital to our goal of understanding what debits and credits mean, but I think it’s worth a quick introduction here. Again, based on reasons earlier stated in this article, these debit/credit main category relationships are rules put in place that must be followed in order for the “Accounting Must Be Balanced” rule to remain.

Here is a chart introducing the relationships:

Chart showing Main Categories and if Debits & Credits increase or decrease the category balance

Hopefully, working backward like this has helped put in a true understanding of what Debits and Credits are.

Thanks for reading!

-Gunnar